Recommendation Info About How To Sell Bank Owned Properties

Find an reo property using any one of the methods listed above.

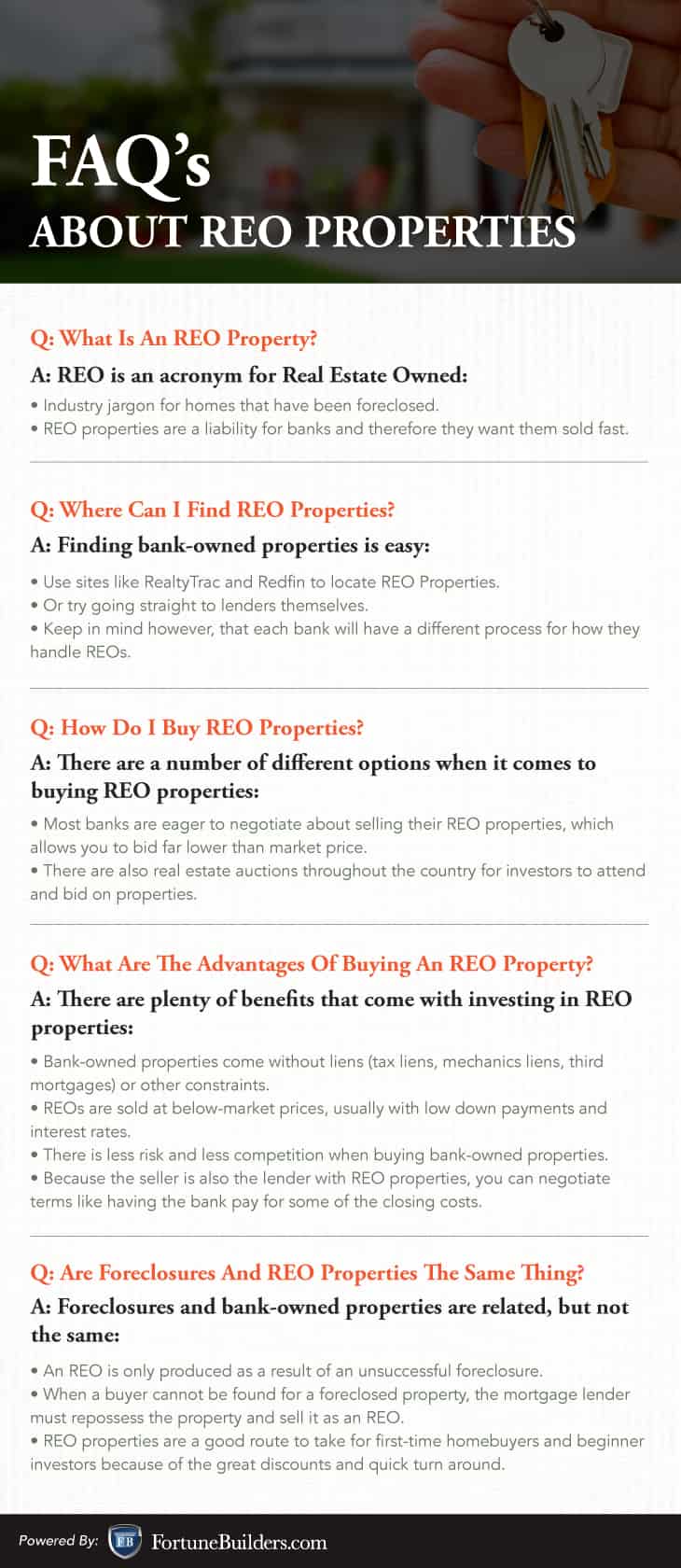

How to sell bank owned properties. Bank owned homes are a unique type of real estate that is sold directly to the public by banks. Finally, berenberg bank cut shares of four corners property trust from a “buy” rating to a “hold” rating and cut their price objective for the stock from $31.00 to $30.00 in a. The main advantages of buying an reo property are:

Bank owned properties have become a common option these days for homeowners and real estate investors. These homes have become very popular among. Bank owned foreclosures in inventory are called reos, or real estate owned. [1].

Reo is an acronym for real estate owned and is industry jargon for foreclosure property repossessed by banks or lenders. When a bank takes title to real property through foreclosure or some other negotiated settlement, it is then owned by the bank, marketed, and sold at fair market value. Short sale properties are still in the possession of the current owner.

If a lender or bank is the highest bidder at a foreclosure. Plus, they have a fiduciary responsibility to advocate for your best interests. Banks also like to see that you have completed bpo’s and are ready to list reo properties for.

Even better, the seller typically pays the buyer’s agent, so there’s no additional cost for you to hire. Not pricing reo properties right in the market will reduce your chances of getting reo listings. Averill woods homes for sale $193,183.

When a bank can't close a foreclosure sale at auction, it sends that property to its inventory. They occur when a lender permits the owner to sell the home for less than what they owe on their. Normally, banks wouldn't be in the business of selling real estate, but bank owned homes are.

/housing7-5bfc2b614cedfd0026c11183.jpg)