Fantastic Tips About How To Keep Corporate Records

Some corporations still use this method, but many opt for more environmentally.

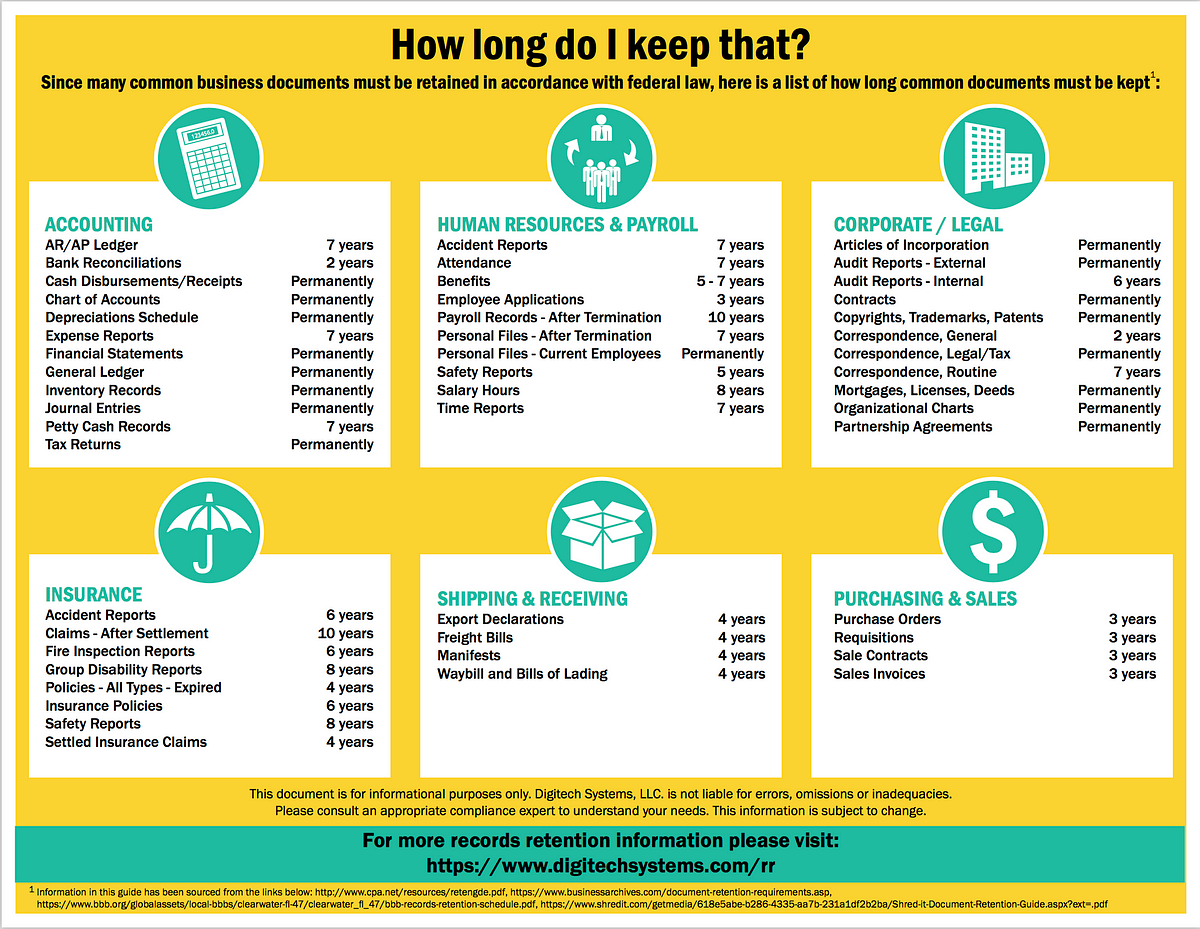

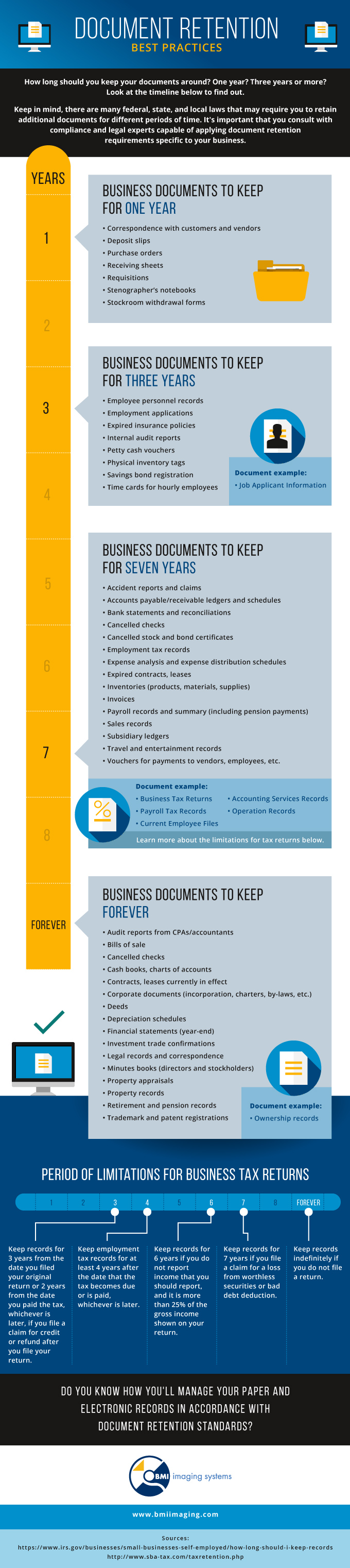

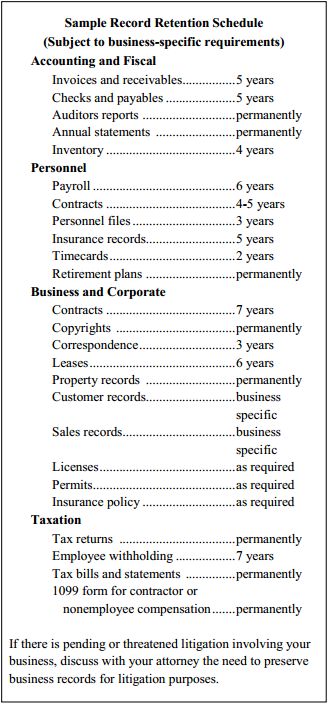

How to keep corporate records. You should keep them in an orderly fashion and in a safe place. The first step to creating a “corporate veil” is to have a business entity, such as a corporation or a limited liability company (llc). Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file.

Keep records for six years if you do not report income that you should report and it is more than 25% of the gross income shown on your return. How to keep corporate records method 1 preserving organizational documents. Except in a few cases, the law does not require any special.

At the southern edge of parry sound, ont., 10 neat rows of solar panels stand where a landfill used to be. Despite pleading guilty to three drug offences, donnie joshua patrick aymes will keep his criminal record clean if he manages to stay out of trouble for the. But, just having a business entity is not.

So, if you're operating your company as a corporation, s. How to keep proper corporate records. 5 tips for keeping business records 1.

For instance, organize them by year and type of income or expense. The office of secretary of state handles. The following are some of the types of.

The basic premise is simple: When corporations amalgamate or merge to create a new corporation, the new corporation must usually keep the business records of each. Maintain and update financial transaction records;